Concerns About Seattle's B&O Tax Plan

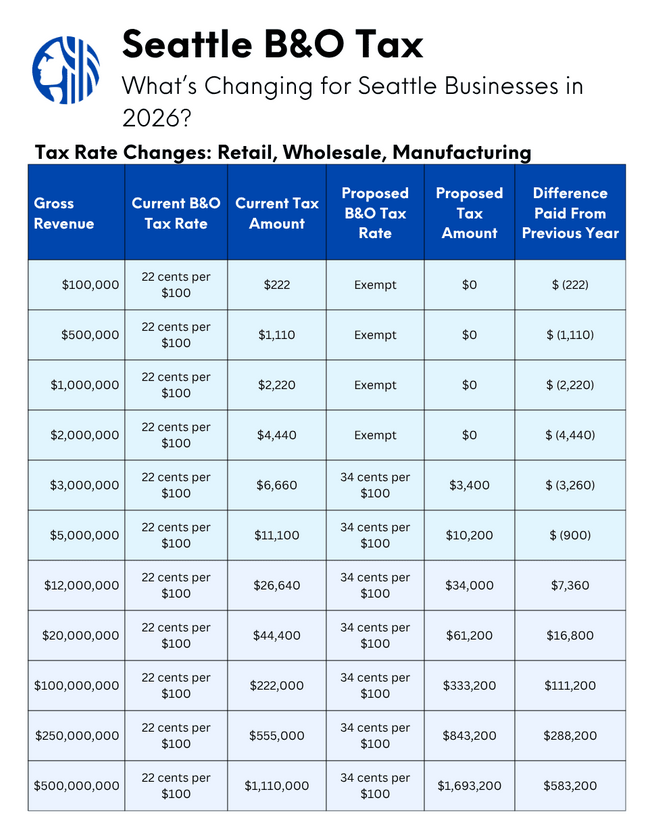

Seattle is considering a new tax proposal that would raise the Business & Occupation (B&O) tax rate while also increasing the exemption threshold for small businesses. On paper, it looks like a win for smaller companies — the exemption would jump from $100K to $2M in gross receipts, removing B&O liability for about 16,000 businesses. A new $2M deduction starting in 2027 would further lighten the load for many.

However, beneath the surface, the plan raises serious concerns:

• Impact on Growth Businesses: Many startups and small tech firms choose their headquarters based on future projections. If they think they’ll outgrow the $2M deduction soon, Seattle becomes a less attractive place to scale.

• Flight Risk: Larger employers are already pulling back. Major office space exits (e.g., Amazon’s downsizing and new leasing in Sammamish) signal a quiet exit strategy. That puts pressure on local economies dependent on their presence.

• Ecosystem Effect: These exits don’t just impact the companies themselves. The "Seattle Reef" analogy fits — when one piece (like a big employer) dies off, the supporting ecosystem suffers: janitors, electricians, restaurants, baristas, etc. all lose out.

• Revenue Risk: The city expects a net $90M gain from this plan. But if large companies leave, office values fall, property taxes collapse, and sales tax revenue (especially from sectors like construction) shrinks. It’s a short-term sugar high with a long-term hangover.

• Political Timing: Some believe the proposal is more about campaign optics than economic logic — aiming to energize anti-corporate voters in an election cycle.

Seattle has always thrived because of a delicate mix: small businesses, global companies, tech talent, creative sectors. A tax policy that disrupts that balance may do more harm than good.